Master of Arts in Personal Finance Education

PROGRAMME FEATURES

- It is the first Master of Arts programme in personal financial education in Hong Kong, focusing on both theoretical financial knowledge and workplace application skills to improve participants’ competitiveness in the market.

- Participants will be given opportunities to gain practical and first-hand experience in transferring financial knowledge to individuals and the tools to enable them to be professional financial educators, equipping the skills to operate effectively in the three areas of education, business, and society.

- The demand for financial talents in mainland China and Hong Kong is growing rapidly. Graduates have a wide range of employment prospects, including banking and financial institutions, government agencies, educational institutions, and mass media.

- All subjects are taught in English, in order to strengthen participants’ English proficiency and competitiveness in the international market.

The Institute of Financial Planners of Hong Kong (IFPHK) confirms that Master of Arts in Personal Finance Education [MA(PFE)] graduates are eligible to apply for “Fast-track to Certified Financial Planner (CFP) Certification” - List C candidacy. Under the fast-track arrangement, the MA(PFE) graduates will be exempted from taking the CFP certification education program (courses 1 to 3) and the CFP certification examination (foundation level).

PROGRAMME ENQUIRIES

| Hotline : | (852) 2948 8727 |

| Fax : | (852) 2948 8018 |

| E-mail : | mapfe@eduhk.hk |

| Website : | https://www.eduhk.hk/mapfe |

| In person : | Room D3-1/F-22A, Department of Social Sciences and Policy Studies, The Education University of Hong Kong, 10 Lo Ping Road, Tai Po, New Territories, Hong Kong |

| Follow us on | |

ENTRANCE REQUIREMENTS

- Applicants should normally hold a recognised Bachelor’s degree or other equivalent qualifications.

- Applicants whose entrance qualification is obtained from an institution in a non-English speaking system should normally fulfill one of the following minimum English proficiency requirements:

- Overall score of IELTS 6.0 (academic version) (the test should be taken in test centres and the result should be valid within two years); or

- TOEFL score of 80 (internet-based test) (the test should be taken in test centres and the result should be valid within two years); or

- Band 6 in the College English Test (CET) (a total score of 430 or above and the test result should be valid within two years); or

- Grade C or above in GCSE / GCE OL English; or

- Other equivalent qualifications.

- Shortlisted applicants may be required to attend an interview.

For example, if you are applying for 2025/26 academic year, your IELTS / TOEFL / CET6 test must be obtained on or after 1 January 2023.

TOEFL Home Editions, TOEFL MyBest Score, IELTS Indicator, IELTS Online, IELTS One Skill Retake, Duolingo and National Postgraduate Entrance Examination (全國碩士研究生招生考試) are NOT acceptable.

For details, please visit: https://www.eduhk.hk/acadprog/EnReq(Pg)/

Every effort has been made to ensure the accuracy of the information contained in this website. Changes to any aspects of the programmes may be made from time to time as due to change of circumstances and the University reserves the right to revise any information contained in this website as it deems fit without prior notice. The University accepts no liability for any loss or damage arising from any use or misuse of or reliance on any information contained in this website.

PROGRAMME AIMS

The MA(PFE)’s objectives are to:

- equip participants with professional knowledge in finance and necessary skill sets for investment analysis;

- enable participants to formulate and implement comprehensive personal finance education for individuals with different financial backgrounds and needs in a society of prolific lifestyles;

- focus on necessary financial knowledge in personal finance and the application of knowledge and skills required for effective financial decision-making, financial planning and hence training, education, and knowledge transfer; and

- equip participants to meet their career goals in either the financial services sector or financial-related educational/training sector.

Upon successful completion of the programme, participants should be able to:

- demonstrate solid understanding and a broad spectrum of knowledge and concepts in finance and financial management (PILO1);

- critically evaluate the trend and development of financial and investment markets in a global perspective (PILO2);

- integrate financial knowledge in solving personal financial problems and ethical decision making (PILO3);

- possess high professionalism, creativity and competencies as a financial literacy educator (PILO4); and

- transfer and apply research methods and financial knowledge in the context of professional work. (PILO5).

PROGRAMME STRUCTURE

The programme comprises 24 credit points (cps). Participants normally take one year (full-time mode) or two years (part-time mode) to complete the programme. They need to attend classes (in the same or different semester(s)) which may be scheduled on weekday daytime/evenings, weekends and/or during long holidays at the Tai Po Campus / Tseung Kwan O Study Centre / North Point Study Centre / Kowloon Tong Satellite Study Centre and/or other locations as decided by the University.

PROGRAMME CURRICULUM

Students are required to complete 24 credit points for graduation. The normal study pathway is shown as below:

| Full-time Mode: | |||

|---|---|---|---|

| Year | Semester | Courses | Credit Points (cps) |

| 1 | I | Core: Global Financial Market and Instruments (3 cps) | 12 cps |

| Core: Quantitative Analysis for Financial Studies (3 cps) | |||

| Core: FinTech and Consumer Finance (3 cps) | |||

| Core: Ethical Issues and Decision Making in Personal Finance (3 cps) | |||

| II | Core: Financial Risk Management for Investment (3 cps) | 9 cps | |

| Core: Research Methods in Finance (3 cps) | |||

| Core: Financial Literacy Education for All Aged Groups (3 cps) | |||

|

*Elective: |

3 cps | ||

| Total Credit Points | 24 cps | ||

*Choose one out of four elective courses

*The offering of elective courses and the quota offered is subject to the Programme’s decision and students enrolment. It may vary in each academic year.

| Part-time Mode: | |||

|---|---|---|---|

| Year | Semester | Courses | Credit Points (cps) |

| 1 | I | Core: Global Financial Market and Instruments (3 cps) | 6 cps |

| Core: Quantitative Analysis for Financial Studies (3 cps) | |||

| II | Core: Financial Risk Management for Investment (3 cps) | 6 cps | |

| Core: Research Methods in Finance (3 cps) | |||

| 2 | I | Core: FinTech and Consumer Finance (3 cps) | 6 cps |

| Core: Ethical Issues and Decision Making in Personal Finance (3 cps) | |||

| II | Core: Financial Literacy Education for All Aged Groups (3 cps) | 3 cps | |

| *Elective: Investment Analysis and Portfolio Management for Personal Needs or Contemporary Issues in Personal Finance Education or Internship Programme in Personal Finance Education or Sustainable Finance and ESG Investment |

3 cps | ||

| Total Credit Points | 24 cps | ||

*Choose one out of four elective courses

*The offering of elective courses and the quota offered is subject to the Programme’s decision and students enrolment. It may vary in each academic year.

There are two options for students to complete the 24 credit points for graduation:

1) Students who opt for coursework will need to take 8 courses

| Component | Credit Points (CPs) |

|---|---|

| All 7 core courses and 1 Elective | 24 |

| Total | 24 |

2) Students who have sufficient research competencies, obtained approval, and opt for the Research Project can be exempted from taking the Research Methods in Finance and the elective course. Their study path is as follows:

| Component | Credit Points (CPs) |

|---|---|

| 6 core courses | 18 |

| Research Project | 6 |

| Total | 24 |

MEDIUM OF INSTRUCTION

The medium of instruction is English.

Every effort has been made to ensure the accuracy of the information contained in this website. Changes to any aspects of the programmes may be made from time to time as due to change of circumstances and the University reserves the right to revise any information contained in this website as it deems fit without prior notice. The University accepts no liability for any loss or damage arising from any use or misuse of or reliance on any information contained in this website.

| Course Title | Course Code & Outline | |

|---|---|---|

| Master of Arts in Personal Finance Education (One-year Full-time / Two-year Part-time) | Global Financial Market and Instruments | BUS6031 |

| Quantitative Analysis for Financial Studies | BUS6032 | |

| FinTech and Consumer Finance | BUS6033 | |

| Ethical Issues and Decision Making in Personal Finance | BUS6034 | |

| Financial Risk Management for Investment | BUS6035 | |

| Research Methods in Finance | BUS6036 | |

| Financial Literacy Education for All Aged Groups | BUS6037 |

Elective: BUS6038 Investment Analysis and Portfolio Management for Personal Needs | BUS6039 Contemporary Issues in Personal Finance Education | BUS6046 Internship Programme in Personal Finance Education | BUS6071 Sustainable Finance and ESG Investment

Research Project: BUS6040 Research Project

Any aspect of the courses and course offerings (including, without limitation, the contents of the course and the manner in which the course is taught) may be subject to change at any time at the sole discretion of the University if necessary. Without limiting the generality of the University’s discretion to revise the courses and course offerings, it is envisaged that changes may be required due to factors including staffing, enrolment levels, logistical arrangements, curriculum changes, and other factors caused by change of circumstances. Tuition fees, once paid, are non-refundable.

TUITION FEE

The programme is offered on a self-financed basis. The tuition fee for the whole programme is HK$173,000 for 2025/26 cohort.

ENTRANCE SCHOLARSHIP

Entrance Scholarship is available and awarded on the basis of academic merits with consideration of non-academic achievement.

Veteran advised MA(PFE) students on career development in the finance sector

Master of Arts in Personal Finance Education [MA(PFE)] Programme invited Mr Xie Long, an experienced enterprise trainer, to deliver a financial career advising session for our students.

Dr TAN Weiqiang, Programme Leader of MA(PFE), presented a Certificate of Appreciation to Mr Xie.

Mr Xie Long is a commercial bank veteran with over 20 years of experience in financial management and enterprise training. His expertise covers career planning in finance, credit risk control for banking, banking marketing, team management, banking compliance management, and positive leadership. He holds a Master of Business Administration degree from The Hong Kong Polytechnic University. Mr Xie has served in the Industrial and Commercial Bank of China (ICBC), Ping An Bank, Standard Chartered Bank Group, and ZAC. During his tenure as Channel Director and Executive Director at ZAC, Mr Xie was also responsible for in-house training for the business teams and the cadre members.

Mr Xie shared the career advice with our students.

This sharing session framed an overview of the banking and other financial fields for MA(PFE) students and greatly inspired them in their career development in finance. Mr Xie shared many practical and tailored suggestions with our students on their career development in finance, including commercial banking, internet finance, and corporate finance. He also shared his rich experience in banking management with MA(PFE) students.

Specialist in AI and Cybersecurity shared his insight on FinTech Regulations

On 7 November 2023, the Master of Arts in Personal Finance Education [MA(PFE)] Programme invited Institute of Financial Technologists of Asia (IFTA) to share the prospects of FinTech industry in Hong Kong, and invited Dr Arvin Tang, Hong Kong Applied Science and Technology Research Institute (ASTRI), to share the latest breakthrough in the regulatory technology within the FinTech industry.

Dr TAN Weiqiang, Programme Leader of MA(PFE), presented the certificates of appreciation to Dr Arvin TANG, (ASTRI) and Ms Yolanda CHAU (IFTA).

At the beginning, Ms Yolanda Chau from Institute of Financial Technologists of Asia (IFTA) described an overview on the FinTech trends in Hong Kong, including the talent demands and career advising for the prospective FinTech practitioners. She also introduced IFTA professional designations - Certified Financial Technologist (CFT). CFT is a globally recognised certification programme for FinTech practitioners.

Ms Yolanda CHAU shared the FinTech trends in Hong Kong.

Later, Dr Arvin Tang, the Director of Multimedia Systems and Analytics under the technical division of the Trust and AI Technologies division at Hong Kong Applied Science and Technology Research Institute (ASTRI), shared the latest regulatory technology in FinTech with our students. Dr Tang discussed the regulatory challenges of data protection in FinTech and introduced ASTRI solution to it, namely, a self-developed federated learning platform developed by ASTRI. This federated learning platform motivates the machine learning training and alternative data to facilitate the regulatory improvement, which is also applied in establishing a new ecosystem for the bank industries. Dr Tang also illustrated some empirical evidence to enhance our students’ cybersecurity literacy.

Dr TANG shared the latest regulatory technology in FinTech with our students.

Seminar on Digital Transformation in Asset Management Industry

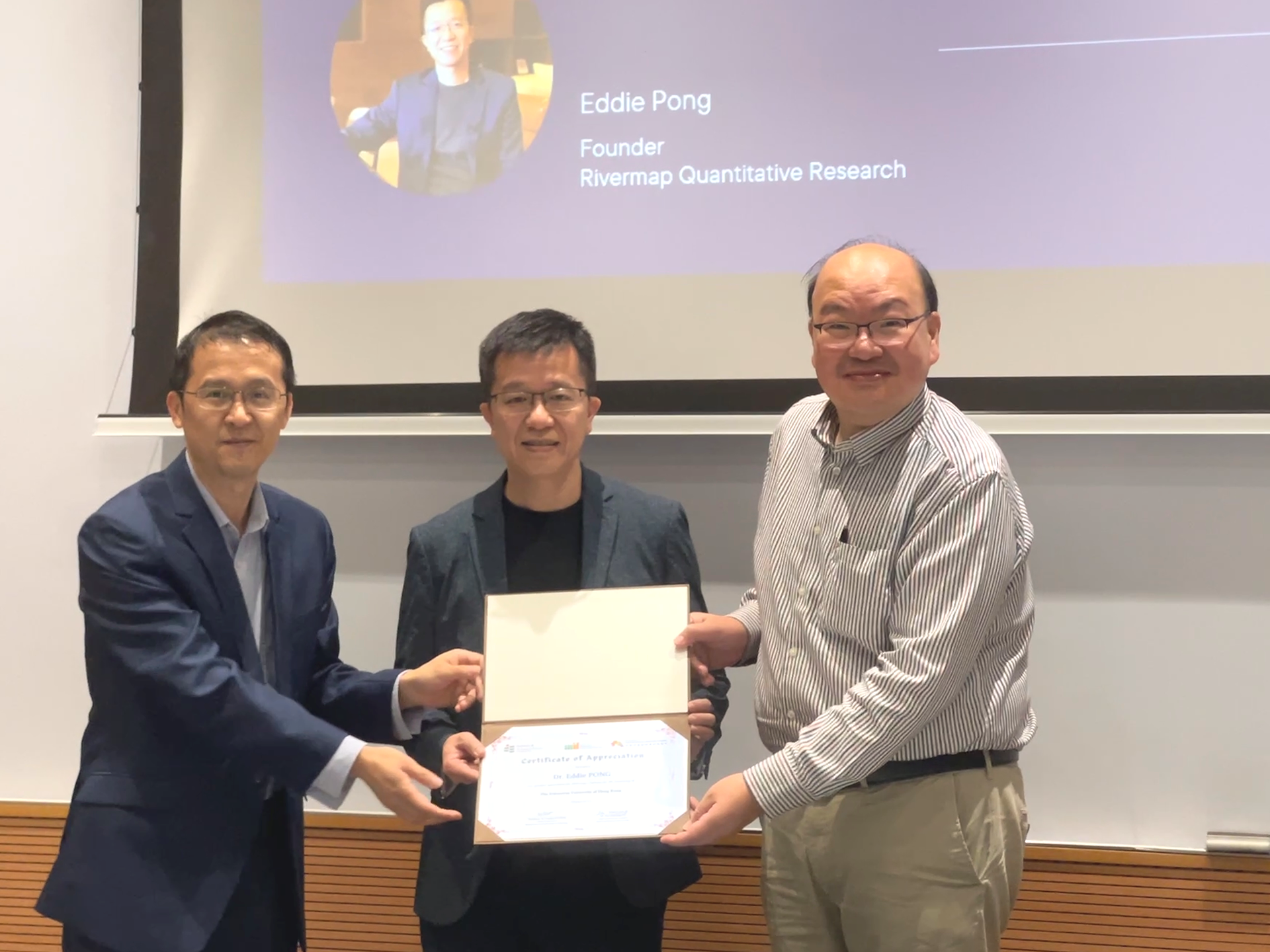

On 7 November 2023, a seminar themed on Digital Transformation in the Asset Management Industry was successfully held at The Education University of Hong Kong, jointly organised by the Department of Mathematics and Information Technology (MIT) and the Department of Social Sciences and Policy Studies (SSPS).

Professor YU Leung Ho Philip (right standing), Head of Department of MIT, and Dr HU Zhiyong Fox (left standing), Acting Head of Department of SSPS presented a Certificate of Appreciation to Dr Eddie PONG (middle standing) as a gratitude.

Professor LI Wai Keung (first from right hand side), Dean of FLASS, also attended the seminar.

Dr Eddie Pong, the speaker of the seminar, is an expertise in quantitative investment analytics and software development. He is the founder of Rivermap Quantitative Research, a FinTech company in Hong Kong.

Dr Pong is experienced in investment management and quantitative analysis. He started his career in London where he worked as an investment manager at Amundi Asset Management. He then moved to ING Investment Management to work in the engineered investment strategies group. Eddie was Head of Asia Pacific Research at FTSE Russell where he oversaw the research and analytics function in the Asia Pacific region.

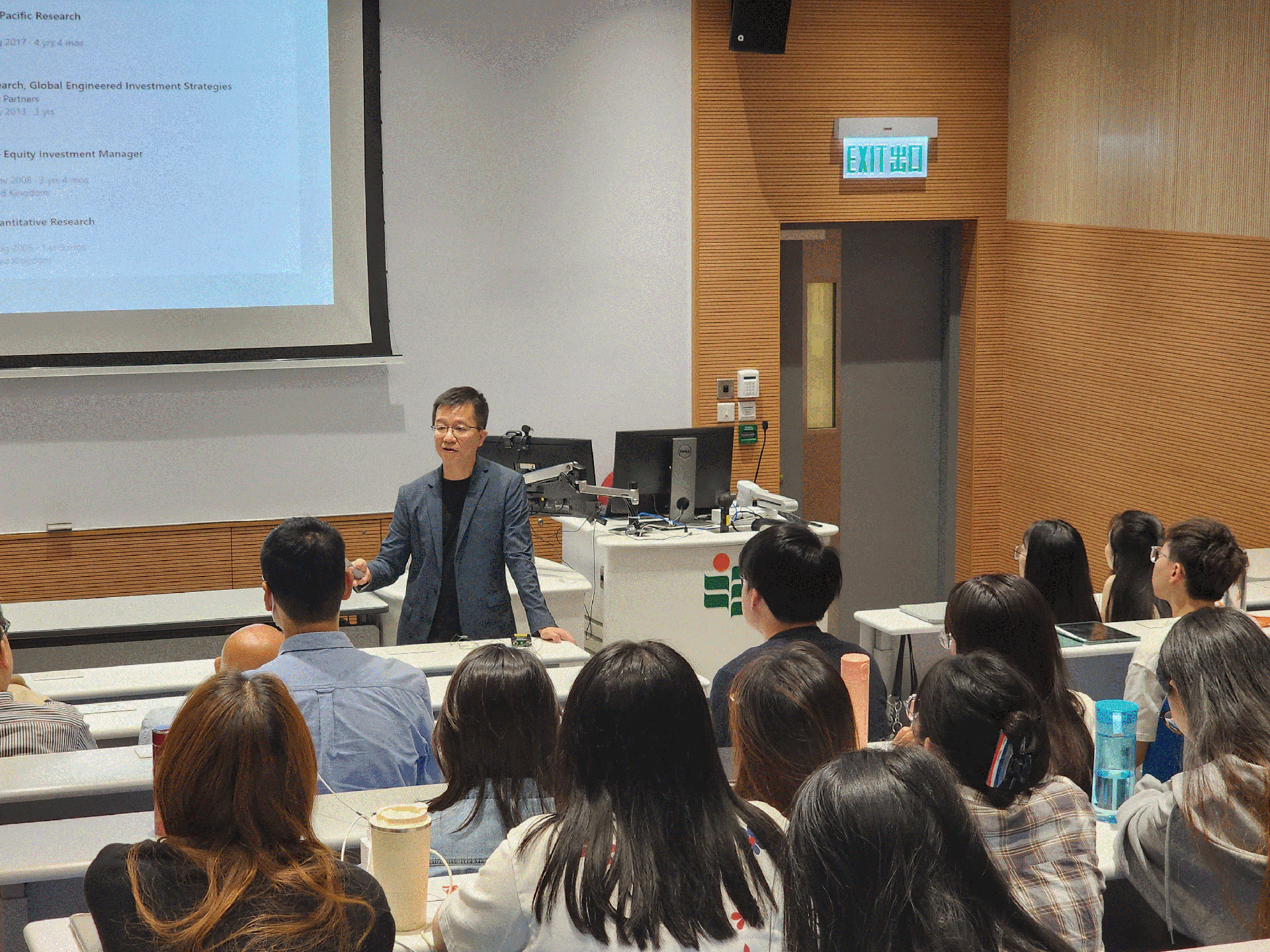

Dr Eddie PONG discussed the latest trends in the asset management industry.

At the seminar, Dr Pong discussed the latest trends in the asset management industry, focusing on the increasing importance of technologies like machine learning, natural language processing (NLP), and cloud computing. Additionally, he explored the growing emphasis on new investment areas such as megatrends and the integration of environmental, social, and governance (ESG) factors.

Dr Eddie PONG interacted with the students on the professional development in asset management.

Dr Pong advised on students’ professional development in asset management field, such as the skills necessary for professionals to succeed, the opportunities and challenges in wealth and asset management.

Seminar: Professor Chor-yiu SIN on Re-balancing hedge position with statistics of hedge ratios

On October 6 (Friday), 2023, Professor Chor-yiu SIN delivered a seminar on “Re-balancing hedge position with statistics of hedge ratios: concepts and applications”. During the seminar, Professor SIN presented his latest findings on hedge efficiency improvement with econometric models to the community of EdUHK.

Professor SIN has been a Professor of the Department of Economics, College of Technology Management of National Tsing Hua University (NTHU), Taiwan since 2014. He devotes to excellence in research on time series econometrics and financial econometrics. His research findings have been published in many international referee journals.

Professor Chor-yiu SIN was delivering the seminar.

Professor Chor-yiu SIN was delivering the seminar.

This seminar was jointly organised by the Department of Mathematics and Information Technology (MIT) and the Department of Social Sciences and Policy Studies (SSPS), supported by Master of Arts in Personal Finance Education Programme [MA(PFE)]. Academics and students from various majors attended the seminar.

Professor LI Wai Keung (standing), Dean of FLASS, delivered a brief introduction to Professor SIN at the start of the seminar.

Professor YU Leung Ho Philip (left), Head of Department of MIT, and Dr CHAN Kit Wa Anita (right), Associate Head of Department of SSPS presented a Certificate of Appreciation and a souvenir to Professor SIN (centre) as a gratitude.

Seminar: Wealth Management Development in GBA and CFP Certification

On October 4, 2023, MA(PFE) Programme invited Mr Edwin Cheung, Vice Chairman for Institute of Financial Planners of Hong Kong (IFPHK) to deliver a seminar on wealth management in the Greater Bay Area.

During the seminar, Edwin introduced the Certified Financial Planner (CFP) Certification and the career opportunities for CFP holders to the EdUHK students.

Students graduated from MA(PFE) Programme will be exempted from taking three educational courses and one foundational examination for CFP Certification under the fast-track certification offered by IFPHK.

Dr Tan Weiqiang (right), Programme Leader of MA(PFE) presented the Appreciation Certificate to Mr Edwin Cheung (left) from IFPHK.

Mr Edwin Cheung shared his insight on Wealth Management Development in the GBA.

Seminar on ESG Investment, Green Finance and the introductory session for Certified ESG Analyst (CESGA)

On September 27, 2023, Mr Ericson Lee conducted a sharing session for the students from Master of Arts in Personal Finance Education [MA(PFE)) Programme and other majors at EdUHK.

Mr Ericson Lee is currently a dedicated member of the Green Finance Engagement at Friends of the Earth (Hong Kong), focusing on ESG education and green finance and policy engagement. He is a professional with knowledge on ESG analysis, sustainable investment strategies, ESG integration and valuation processes. Mr Ericson Lee is also a holder of Certified ESG Analyst (CESGA) accreditation.

The sharing session was themed in “The ESG Imperative: Why is it essential and how does it impact all of us?”. During the seminar, Mr Ericson Lee pictured the trends in the fields of ESG investment and sustainable finance. Moreover, He also explored the career opportunities within the ESG industry and shared the accreditation path towards Certified ESG Analyst (CESGA) with students present.

Dr Tan Weiqiang (right), Programme Leader of MA(PFE) presented the Appreciation Certificate to Mr Ericson Lee (left) from Friends of the Earth (HK).

Students from MA(PFE) and other programmes took a photo with Mr Lee.

Mr Ericson Lee was sharing the industrial trends in ESG and Green Finance.

Financial education in a Tech-plus era: MA(PFE) students won the Bronze Prize at Personal Finance Ambassador Programme 2022/23

CSQY Team (財思錢擁 in Chinese), formed by five MA(PFE) students, won the Bronze Prize at the Personal Finance Ambassador Programme 2022/23 on June 3, 2023.

CSQY Team, as the Personal Finance Ambassador, promoted the financial education themed on “Money in the Tech” for the EdUHK students. They implemented various financial education activities, such as the Metaverse Platform, Instagram knowledge page, game-based workshops, booth consulting, etc. The campaign has attracted over 500 EdUHK students to participate in.

In March 2023, 45 students participated in the showcase to experience the Metaverse Financial Education Platform in person. The Metaverse Platform was formulated by our CSQY Team, where the EdTech was incorporated with financial knowledge.

The EdUHK students learned more about the “Tech-plus” financial instruments. They grew some responsible attitudes toward the emerging FinTech from the campaigns.

MA(PFE) students won the Outstanding Award in the Quest for Securities & Investment Elites (QSIE) Case Analysis Competition 2022

Mr. WANG Chaowei and Mr. CHEN Zijun, the students from the Master of Arts in Personal Finance Education Programme [MA(PFE)], won the Outstanding Award in the Quest for Securities & Investment Elites (QSIE) Case Analysis Competition 2022 on 26 November 2022.

Awardees of the Outstanding Award: Mr. WANG Chaowei (standing middle at the front row) and Mr. CHEN Zijun (standing left at the front row).

The Competition was organized by the EL Education Academy, with the sponsorship from the Chartered Securities and Investment Institute (CISI) and the title-sponsorship from the Hang Seng Investment Management Ltd. The CISI is a global professional body for those in the financial and investment profession.

Three teams from MA(PFE) entering the the final round, and Dr TAN Weiqiang, Programme Leader of MA(PFE)

Competition Poster (Source: the Elite Education Institute)

The Competition attracted over 60 teams from Hong Kong, Macau, and Mainland universities. 18 teams were shortlisted to enter the final round presentation, including three teams from the MA(PFE) Programme. This Competition was designed to equip the participants with Securities & Investment knowledge and good English skills, enabling students to be competitive when entering the job market.

Opening Ceremony of the Competition

Panel of Judges for the Competition was comprised of the professionals from the investment field, whose affiliate originations included the Professional Assessment Panel in Sustainable & Responsible Investment at CISI, Hang Seng Investment Management Ltd, and Institute of Professional Education and Knowledge (PEAK).

Student teams from MA(PFE) entering the final round

| Team 5 |

WANG Chaowei, CHEN Zijun (Awardees of Outstanding Award) |

| Team 6 | PAN Wenkai, BAI Longxiang |

| Team 15 | LI Wenbo, GAO Fan |

Tone Management Between Languages

Dr Hung Wan KOT, Assistant Professor in Finance at The University of Macau, delivered a research seminar on the topic of Tone Management Between Languages on November 22, 2022. Focusing on Chinese and English versions of the profit warning and positive alerts in the Hong Kong stock market, Dr KOT interpreted the mechanism of tone management in the stock market. Dr KOT also introduced the effect of corporate governance on Tone Management.

Railways, Telegraph and Technology Adoption: The Introduction of American Cotton in Early 20th Century China

On November 10, 2022, Dr Steffan QI, WeBank Institute of Fintech, Shenzhen University, delivered a research seminar to the MA(PFE) students. The research of Dr QI with his Team reveals the interactions among infrastructure, information accessibility, new technology adoption and welfare enhancement, using the historical data to empirically re-investigate early 20th-century China.

Volatility spillovers across NFTs news attention and financial markets

On October 27, 2022, MA(PFE) Programme invited Dr Wang Yizhi to deliver a research seminar on Volatility spillovers across NFTs news attention and financial markets. In the seminar, Dr Wang presented his econometric approach to analyse the Volatility spillovers across NFTs news attention and financial markets. Dr Wang also shared some tools for NFTs analysis, like the indices.

Workshops on Virtual Banking in Hong Kong delivered by specialists from the leading local virtual bank

MA(PFE) Programme organised workshops themed in virtual banking on September 29 and October 19 2022, respectively.

On September 29, Ms Yvonne Leung, the Executive Director and Chief Executive of Ant Bank (HK), shared her practical insights on operating virtual banking. She also introduced the opportunities and challenges of virtual banking in Hong Kong.

On October 19, Mr Sam HO, ACE and CFO of Ant Bank (HK), delivered a workshop about Business Models and Products in Banking and FinTech. He presented the features of the products of Ant Bank (HK). He introduced the business structure of the banking sectors to the MA(PFE) students.

Students of MA(PFE) reflected that they learnt a lot about the FinTech and virtual banking sector and obtained some valuable career advice from the Q&A session.

The Effects of Central Bank Digital Currencies (CBDC) News on the Financial Market

Professor Samuel A. Vigne, the Professor of Finance from LUISS University, Rome, Italy, delivered a research seminar on central bank digital currencies (CBDC) to the MA(PFE) students on October 18, 2022.

Applying CBDC Uncertainty Index (CBDCUI) and CBDC Attention Index (CBDCAI), Professor Vigne presented a quantitative analysis of the FinTech issues concerning digital currencies.

FinTech application in insurance among the Greater Bay Area

On October 3, 2022, the Department of Social Sciences (SSC) invited the elites at ARTA TechFin Corporation Limited to introduce the FinTech application in insurance in GBA, especially in Hong Kong SAR. Mr Peter Fang, Head of Insurance at ARTA, introduced the life and general insurance markets in Hong Kong. He also shared his views on regulatory technology and the Hong Kong Insurance Authority Sandbox initiatives.

The Dean of FLASS, Prof. Li Wai Keung, and the Head of the Department of SSC, Prof. Peter Cheung, presented the Certificate of Appreciation to the Guests.

This seminar also included a career advising session. Ms Imma Ling, the Treasurer of the University Council at EdUHK, and some other members from ARTA interacted with the student participants on career development in the finance industry.

Career prospects for the fresh students: introduction to the wealth management industry and CFP Certification

Mr Edwin Cheung, Vice Chairman of the Institute of Financial Planner Hong Kong (IFPHK), delivered a sharing session for the fresh MA(PFE) students on September 28 2022. The talk was about the Greater Bay Area wealth management industry, particularly in Hong Kong.

Mr Edwin Cheung also introduced the Certified Financial Planner (CFP) Certification and the career prospects as a financial planner to fresh MA(PFE) students.

Green finance specialist and ESG analyst gave a talk on ESG certificate to MAPFE students

Mr Anthony Cheung, a specialist in green and sustainable investments in Asia, gave a sharing on the topic "ESG Analyst certificate (CESGA) and the importance of ESG investment in the Hong Kong finance sector" to MAPFE students on May 5, 2022.

Certified ESG Analyst (CESGA) program by the European Federation of Financial Analysts Societies (EFFAS) is an internationally recognised certificate for ESG professionals.

Mr Anthony Cheung was the first in Asia who attained the Certified ESG Analyst (CESGA) designation and was awarded Regional ESG Leader Award by Insights and Mandate (I&M) in 2019. Anthony is also a Fellow of CPA Australia.

Vice Chairman of Institute of Financial Planner HK shared his insight on Wealth Management in Greater Bay Area

The Master of Arts in Personal Finance Education (MAPFE) programme invited Mr. Edwin Cheung (Vice Chairman of Institute of Financial Planner Hong Kong) to give a talk to the students on February 28, 2022.

In the online seminar, Edwin shared the recent development of wealth management industry in the Greater Bay Area, especially Hong Kong. He also introduced the Certified Financial Planner (CFP) Certificate to the students.

Mr. Edwin Cheung is currently Vice Chairman in Development and the Chairman of the Assessment and Compliance Committee for Institute of Financial Planners of Hong Kong.

More details in Chinese version: https://mp.weixin.qq.com/s/CZgYt6nTtPGXnDuPvSEQcw

Congratulations to the MA(PFE) team which won the Bronze Award of the Personal Finance Ambassador Programme 2021/22

Four MA(PFE) students (Xiao Shiqi, Chen Weiwei, Liu Yutong, Ou Shiteng) formed the team “Budget BOX” and won the Bronze Award of the Personal Finance Ambassador Programme 2021/22 on January 15, 2022. The Personal Finance Ambassador Programme 2021/22 was co-organised by HKEX Foundation Limited, Investor and Financial Education Council, and St James’ Settlement.

Under the theme of “Digital Personal Finance”, 14 teams from the local tertiary institutions were shortlisted and trained as Personal Finance Ambassadors to develop on-campus financial education project. Six teams were selected to compete for awards at the Presentation and Award Ceremony.

Budget BOX, as the Personal Finance Ambassador, conducted both online (Instagram posts, WhatsApp group activities and game websites) and offline campaigns (booths and workshops) to boost the knowledge on Digital Personal Finance among EdUHK students. The campaigns have involved over 350 students of EdUHK and over 60 students participated in the workshop lecture on “University Students' Money Management in the big data era”.

Some students of EdUHK get to know their own personal financial status, risk tolerance and produce their personal financial wellness proposal under the guidance of Budget BOX.

MA(PFE) students will continue to organise the workshops on personal finance in the further days.

For sharing from the Bronze Award team “Budget BOX”, please go to the article via the following weblinks:

(Chinese version only)

參賽感言(一)https://mp.weixin.qq.com/s/rmeScl3t36yJRGqatJKYGA

參賽感言(二)https://mp.weixin.qq.com/s/RmXtoQ8Hq_rMFX9Ky4BEZQ

MAPFE programme organized the workshop on “University Students' Money Management in the big data era”

The Master of Arts in Personal Finance Education (MAPFE) programme organized the first on-campus financial education workshop on December 8, 2021. The workshop focused on “How college students manage money in the big data era.”

The MAPFE student, Ms. Morrian XIAO, acted as the instructor and gave the lecture to help the participants manage money properly. The workshop also introduced savings, consumption, investment, and how to prevent online financial fraud.

About 60 students from various majors in the EdUHK participated in the workshops in person or online. The workshop aims to increase their awareness and understanding of financial literacy.

The MAPFE students will organize a series of on-campus seminars/workshops/games on finance education, including money and credit management, the introduction of cryptocurrency, MPF management, retirement plan to the EdUHK community.

This project, “On-campus financial literacy education in the EdUHK community,” is supported by the Specific Student Empowerment Work Scheme (Specific SEWS) 2021/22. These activities will be held from December 2021 - June 2022.

MAPFE programme organized job hunting training workshops

The Master of Arts in Personal Finance Education programme organized training workshops on “How to Start Job Hunting in Hong Kong” on September 29 and October 6, 2021, respectively. The speaker, Ms Jacqueline Lo, gave the talks to help students know where to obtain the job vacancy information, prepare the CV and cover letter, and learn the interview etiquette.

Financial Elite Shares professional perspective on Hong Kong’s Derivative Securities Market

Mr Martin Wong, the Executive Director and Head of Exchanged Traded Solutions Sales (Asia Pacific) of BNP Paribas, gave a professional sharing about “Derivative Securities Markets in Hong Kong” on October 5, 2021.

Data Scientist Gave Academic Seminar on Financial Risk Management

Prof. Li, Wai-Keung, the Research Chair Professor of Data Science, and the Dean of the FLASS at The Education University of Hong Kong (EdUHK), gave an academic seminar to the students in the programme Master of Arts in Personal Finance Education.

Prof YU Wai Mui Christina, Dr TAN Weiqiang, EdUHK researchers achieve accolades in diverse fields, China Daily (4 Dec 2024)

https://www.chinadailyhk.com/hk/article/599342

Prof YU Wai Mui Christina, Professor Christina Yu on HKJC's financial literacy programme, RTHK (21 Nov 2024)

https://www.rthk.hk/radio/radio3/programme/backchat/episode/989132

譚偉強,《提升基層金融素養 推動共同富裕》,刊於《文匯報》,2024年6月15日。

https://www.wenweipo.com/a/202406/15/AP666ca396e4b05df3a51f7909.html

譚偉強、麥萃才,《增強理財知識 做好退休打算》,刊於《文匯報》,2024年6月7日。

https://www.wenweipo.com/a/202406/07/AP66621855e4b0a7ef3f0436a1.html

譚偉強,《打造國際人才交流高端平台》,刊於《文匯報》,2024年5月27日。

https://www.wenweipo.com/a/202405/27/AP66539778e4b0bd97947372c9.html

譚偉強,《家族辦公室專才培養宜提速》,刊於《文匯報》,2024年4月25日。

https://www.wenweipo.com/a/202404/25/AP66296739e4b01def1fdfece1.html

譚偉強,《教基層學用手機支付 縮小數字鴻溝》,刊於《文匯報》,2024年4月9日。

https://www.wenweipo.com/a/202404/09/AP66144f65e4b009ba85365621.html

教大碩士結合金融和理財教育元素 畢業生運用所學 助人自助出路廣

(明報JUMP, 24 Jan 2024)

https://jump.mingpao.com/career-news/edu-career-supplement-2024/%e6%95%99%e5%a4%a7%e7%a2%a9%e5%a3%ab%e7%b5%90%e5%90%88%e9%87%91%e8%9e%8d%e5%92%8c%e7%90%86%e8%b2%a1%e6%95%99%e8%82%b2%e5%85%83%e7%b4%a0-%e7%95%a2%e6%a5%ad%e7%94%9f%e9%81%8b%e7%94%a8%e6%89%80%e5%ad%b8/

譚偉強、翁明宇,《公社科應介紹內地與本港經濟發展》,刊於《明報》,2023年2月1日。

https://news.mingpao.com/pns/%E8%A7%80%E9%BB%9E/article/20230201/s00012/1675183183696/

譚偉強,《擺脫跨代貧窮 需「學」「研」深度參與》,刊於《明報》,2022年11月17日。

https://news.mingpao.com/pns/%E8%A7%80%E9%BB%9E/article/20221117/s00012/1668618522740/

Learn to be a money sage

(英文虎報 The Standard, 26 Jan 2021)

https://www.thestandard.com.hk/section-news/fc/4/226921/

大學生「碌」卡是精明還是會惹上一身債?

(信報財經新聞, 朱文英博士, 21 Oct 2020)

https://www1.hkej.com/dailynews/culture/article/2610991/

教育小朋友理財 延遲滿足換取更大獎勵

(信報財經新聞, 朱文英博士, 15 Sept 2020)

https://www1.hkej.com/dailynews/culture/article/2581695/

教大明年首辦理財教育碩士

(星島日報, 3 Sept 2020)

https://std.stheadline.com/daily/article/2273209/

教大明年辦理財碩士課 校長張仁良:樂意客串

(明報, 3 Sept 2020)

https://news.mingpao.com/pns/%E6%95%99%E8%82%B2/article/20200903/s00011/1599070176386/

【中環解密】教大首辦理財碩士課程 張仁良或客串

(信報財經新聞, 3 Sept 2020) https://hk.news.yahoo.com/%E4%B8%AD%E7%92%B0%E8%A7%A3%E5%AF%86-%E6%95%99%E5%A4%A7%E9%A6%96%E8%BE%A6%E7%90%86%E8%B2%A1%E7%A2%A9%E5%A3%AB%E8%AA%B2%E7%A8%8B-%E5%BC%B5%E4%BB%81%E8%89%AF%E6%88%96%E5%AE%A2%E4%B8%B2-193100407.html

教大明年開辦個人理財教育碩士課程 校長張仁良或客串上陣授課

(hket.com, 2 Sept 2020)

https://topick.hket.com/article/2742209

講求事實數據的理財教育

(信報財經新聞, 姚偉梅教授, 8 Jun 2019)

https://www1.hkej.com/dailynews/culture/article/2157737/