Bachelor of Arts (Honours) in Personal Finance

Programme Introduction

The Bachelor of Arts in Personal Finance [BA(PF)] is a pioneering undergraduate programme designed specifically to address the financial needs of individuals and households.

What Makes BA(PF) Unique

- Personalized Focus – Further to the training in traditional finance, BA(PF) emphasizes personalized financial advising and wealth management, equipping students to effectively meet individual financial needs.

- Solid Foundations - Students will master key financial principles, including taxation, credit management, retirement planning, and estate planning.

- Stay Ahead of Trends – The programme also covers the latest developments in the global finance sector, such as fintech, risk management, ESG investments, and green and sustainable finance.

Key Features:

- The First Undergraduate Programme in Personal Finance in Hong Kong

- Professional Recognition - Graduates will receive modular exemptions for Certified Banker (CB) Stages I and the Enhanced Competency Framework on Retail Wealth Management (ECF-RWM) from the Hong Kong Institute of Bankers (HKIB), along with exemptions for Course 1 - “Investment Planning and Asset Management”, Course 2 -“Insurance Planning and Risk Management”, and Course 3 - “Tax Planning and Estate Planning” in the Certified Financial Planner (CFP) programme from the Institute of Financial Planners of Hong Kong (IFPHK).

- Discipline-Based, Practice-Oriented Learning - This programme offers a foundation in finance along with professional skills training in personalized financial planning, wealth management, and green finance. It features experiential learning through internships, field visits, and valuable business networking opportunities.

- Diversified Career Prospects - The programme provides diverse career paths in financial services, especially in management, family office business, financial planning, asset advising, credit analysis, etc.

Programme Structure

| Domain | Credit Points (cps) | |

|---|---|---|

| Year 1 Admissions | Senior Year Admissions | |

| Major | ||

| - Major Course | 42 | 24 |

| - Internship | 3 | 3 |

| - Major Interdisciplinary Course | 3 | 3 |

| - Cross-Faculty Core Course | 3 | 3 |

| - Living and Working in Our Country | 3 | / |

| Second Major / Minor / Electives | 30 | 15 |

| General Education | 22 | 6 |

| Language Enhancement | 9 | / |

| Final Year Project (Honours Project / Capstone Project) | 6 | 6 |

| Total: | 121 | 60 |

Notes:

(1) Classes will be held in Tai Po Campus and Tseung Kwan O Study Centre / North Point Study Centre / Sports Centre / Kowloon Tong Satellite Study Centre as decided by the University.

(2) Students admitted into this programme are required to visit the Greater Bay Area (GBA) and/or other parts of Chinese Mainland. The programme may also require students to participate in other non-local learning experience for completion of the programme. While the visits are subsidised, students are required to contribute part of the estimated cost of the visits ("students’ contribution"), whereas any personal entertainment, meals expenses, travel document fee and personal insurance costs shall be at students’ own expense. The estimated cost of the visits and students’ contribution for students admitted to the coming cohort is yet to be available due to a variety of factors such as inflation of cost of the visits, trip duration, traveling expenses, the exchange rate, etc.

Internship / Overseas Study Opportunities

To provide students with experimental learning opportunities for first-hand experience of personal finance and financial advisory, students have to take part in an 8-week supervisory internship programme in the field. The internship opportunity can facilitate students to apply contemporary financial theories and practices to personal finance and financial advisory in authentic situations. It is expected that students can build up their careers and networks in fields like business, non-government organisations and education, with professional training and support through this internship programme.

Career Prospects/Professional Recognition

It is anticipated that the majority of the graduates of the programme can find a diversity of career options in the finance and financial advisory fields, such as financial planner, asset/investment advisor, credit analyst, financial advisor and education trainer/provider who shall play significant roles as being financial educators through their service provisions to customers.

BA(PF) students and graduates are eligible to apply for exemptions for three courses of the Certified Financial Planner (CFP) Certification Education Programme offered by The Institute of Financial Planners of Hong Kong (IFPHK).

To facilitate students acquiring relevant finance professional qualifications, the programme also covers most of the exam syllabus of Chartered Financial Analyst (CFA).

Disclaimer

Any aspect of the courses and course offerings (including, without limitation, the contents of the course and the manner in which the course is taught) may be subject to change at any time at the sole discretion of the University if necessary. Without limiting the generality of the University’s discretion to revise the courses and course offerings, it is envisaged that changes may be required due to factors including staffing, enrolment levels, logistical arrangements, curriculum changes, and other factors caused by change of circumstances. Tuition fees, once paid, are non-refundable.

EdUHK, has not collaborated with any agency in Chinese Mainland or Hong Kong on admission, and does not encourage students to entrust their applications to any third-party agents and we always contact applicants directly on updates regarding the applications. You must complete and submit your own application via the EdUHK online admissions system and provide your own personal and contact details. Please refer to the official EdUHK channels, such as programme websites and the admissions system, for the required information to complete your application.

In the event of inconsistency between information in English and Chinese versions or where an interpretation of the programme content is required, the decision of the University shall be final.

Major

| Course Code | Course Title | Credit Points (cps) |

|---|---|---|

| Major Core Course | ||

| BUS1048* | Global Business Environment and Financial Markets | 3 |

| BUS1049* | Quantitative Analysis in Finance | 3 |

| BUS2013* | Financial Accounting | 3 |

| BUS2050* | Banking and Credit | 3 |

| BUS2051* | Budgeting and Taxation | 3 |

| BUS3052 | Financial Intervention and Counselling | 3 |

| BUS3053 | Financial Technology | 3 |

| BUS3054 | Household Finance and Wealth Management | 3 |

| BUS3056 | Lifelong and Retirement Financial Planning | 3 |

| BUS3057 | Sustainable Finance and ESG Investment | 3 |

| BUS4058 | Ethics and Decision Making in Finance | 3 |

| BUS4059 | Investment Analysis and Portfolio Management for Personal Needs | 3 |

| BUS4060 | Risk Management for Investment | 3 |

| SSC1189* | Introduction to Economics | 3 |

| Cross-Faculty Core Course (offered by SSPS) | ||

| CFB3033 (Component II) | Cross-Faculty Core Course: Component II – Visits in Greater Bay Area | 1 |

| Major Interdisciplinary Course | ||

| INS4084 | Psychology of Money and Financial Decision Making | 3 |

| Internship | ||

| BUS3055 | Internship | 3 |

| Living and Working in Our Country | ||

| BUS2072* | Experiencing Financial Practitioners' workplace and life in Shenzhen | 3 |

Final Year Project

| Course Code | Course Title | Credit Points (cps) |

|---|---|---|

| BUS4061/ BUS4063 |

Honours Project I: Research Methods and Proposal / Capstone Project I: Research Methods and Proposal |

3 |

| BUS4062#/ BUS4064^ |

Honours Project II: Research Report / Capstone Project II: Project Output |

3 |

* For Year 1 Entrants only

# BUS4061 is the pre-requisite for studying BUS4062

^ BUS4063 is the pre-requisite for studying BUS4064

Every effort has been made to ensure that information contained in this website is correct. Changes to any aspects of the programmes may be made from time to time due to unforeseeable circumstances beyond our control and the University reserves the right to make amendments to any information contained in this website without prior notice. The University accepts no liability for any loss or damage arising from any use or misuse of or reliance on any information contained in this website.

Any aspect of the course and course offerings (including, without limitation, the content of the Course and the manner in which the Course is taught) may be subject to change at any time at the sole discretion of the University. Without limiting the right of the University to amend the course and its course offerings, it is envisaged that changes may be required due to factors such as staffing, enrolment levels, logistical arrangements and curriculum changes.

(Oct 2025) Visit the Eco Expo Asia 2025, Explore the New Trend in Green Finance and Green Technology

On October 28, students participated in a VIP Guided Tour of the “Eco Expo Asia 2025” held at AsiaWorld-Expo. With the theme of “Green Technology and New Energy,” the tour provided a valuable opportunity for future finance professionals to explore the cutting edge of green technology development, gain deep insights into the rapidly growing green industry, and discuss its strong connection with finance. It clearly demonstrated the integration of Environmental, Social, and Governance (ESG) investment principles with financial markets. The booming growth in green technology has generated substantial financing demands and innovative investment products, which allow students to realize how to cultivate forward-thinking perspectives in the financial industry during the global move toward carbon neutrality.

(Oct 2025) Trends and Career Opportunities in ESG and Green Finance: Hong Kong Insight from Financial Elite

Mr Paul Pong, Founder and CEO of The Institute of ESG & Benchmark (IESGB), shared insights on the Environmental, Social and Governance (ESG) practices in Hong Kong, and discussed the historical development and future vision of the sustainable disclosure pathway. Moreover, Mr Paul Pong engaged students in career development in the ESG industry and explained the importance of achieving Certified ESG Professional (CESGP) for career advancement.

(Oct 2025) Guangzhou Institute of GBA Experts Share Trends and Prospects of Science and Technology Innovation Investment in the GBA

On October 15, 2025, the [BA(PF)] Programme invited Dr. Jiang Han, a researcher from the Guangzhou Institute of GBA, to conduct a financial research seminar. Dr. Jiang introduced the development progress of the GBA to students. Combined with Think Tank, she analysed the bottlenecks and challenges of the GBA in technological innovation and industrial development, and discussed the implementation pathways and effectiveness of science and technology policies in upgrading industries. Additionally, she shared methodologies and techniques for drafting policy analysis reports. During the seminar, students recognised the core research competency of Tink Tank, which means transforming complex policy issues into clear, implementable policy suggestions.

(Oct 2025) BA(PF) Extracurricular Activity: Relax and Recharge at an Autumn BBQ Party

On October 15, 2025, the [BA(PF)] Programme organized a BBQ Party to help students release stress from the academy and strengthen their fellowship. Stress melted away amidst food and chat, while bonds rose like smoke. The event served as a warm “recharging station”, allowing students to enjoy a moment of relaxation during the intense pace of studies, filling them with joy and energy for the upcoming academic journey.

(April 2025) EdUHK Held an International Symposium on Personal Finance

The Symposium gathered distinguished scholars and practitioners from leading institutions worldwide. This event explored cutting-edge research and innovative practices across key areas including financial literacy, behavioral finance, fintech applications, retirement planning, and inclusive policy solutions. (The Symposium was supported by the Jiangsu-Hong Kong-Macao University Alliance.)

(Mar 2025) EdUHK Alumni Day 2025: "Financial Champions" Booth

Students from the Personal Finance Programme at The Education University of Hong Kong leveraged their knowledge in financial education and wealth management to organize an interactive financial literacy booth. Through engaging activities such as mini-games and informative displays of practical financial tips, they effectively promoted the seven core competencies outlined in the “Hong Kong Financial Competency Framework”, including maintaining balanced budgets, practicing sensible savings, making sound investments, understanding investor protection and fraud prevention, as well as being aware of consumer rights and responsibilities.

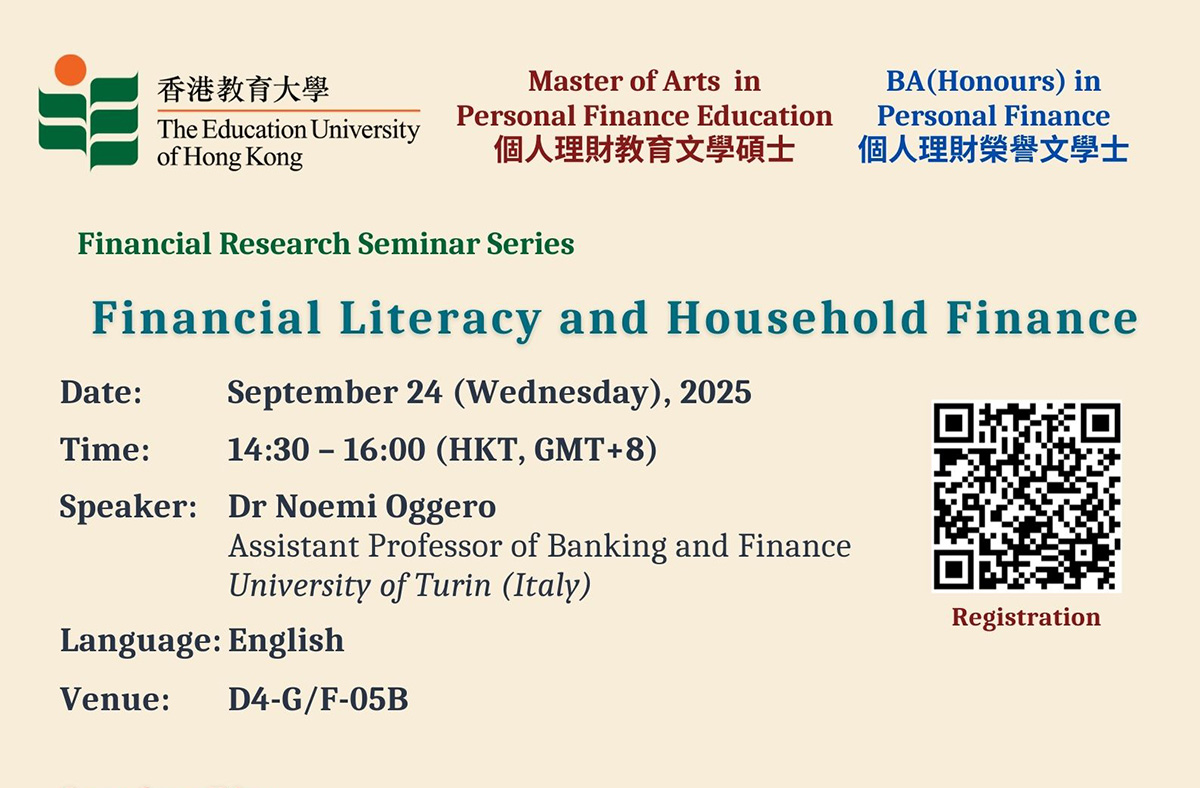

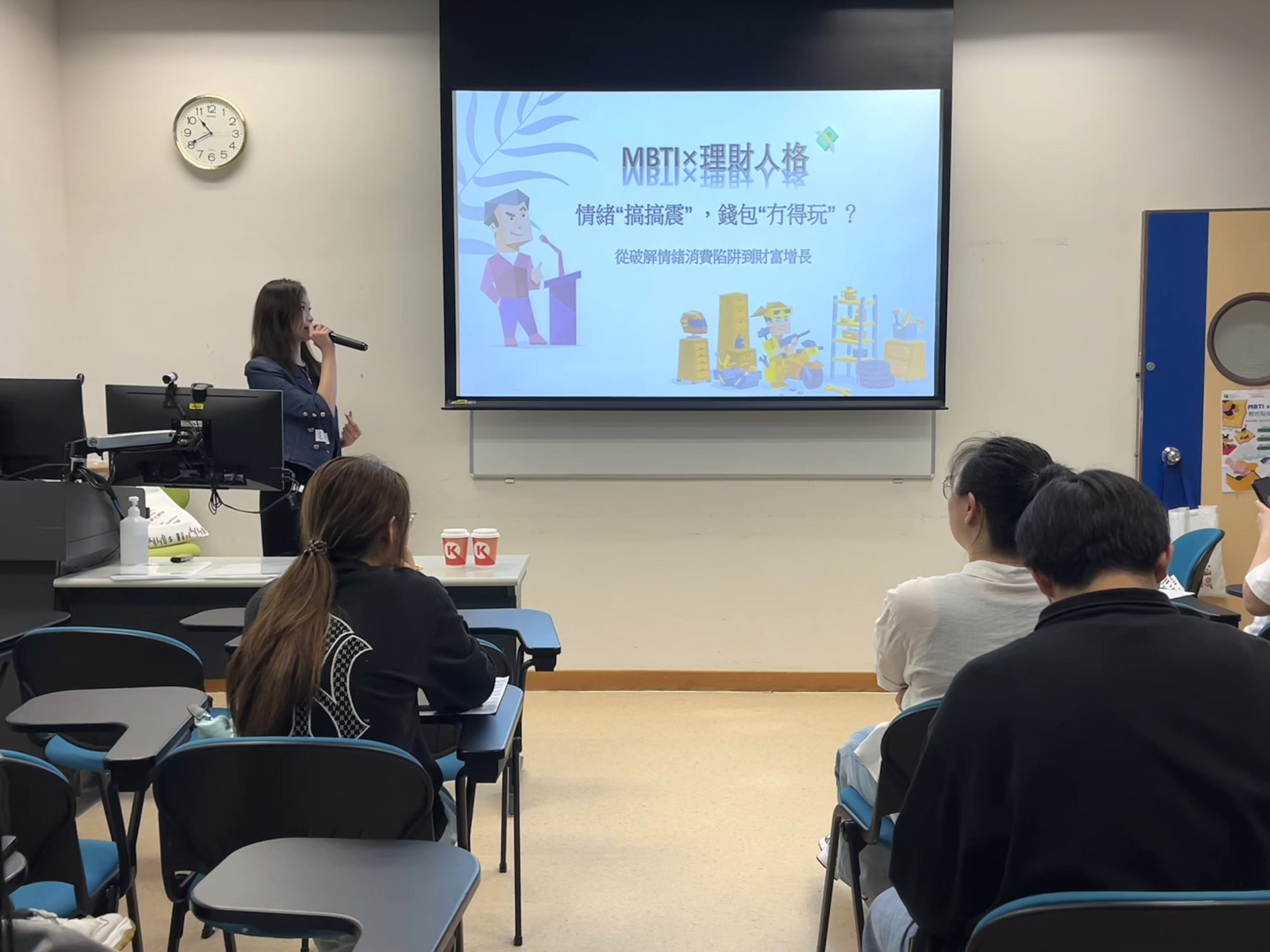

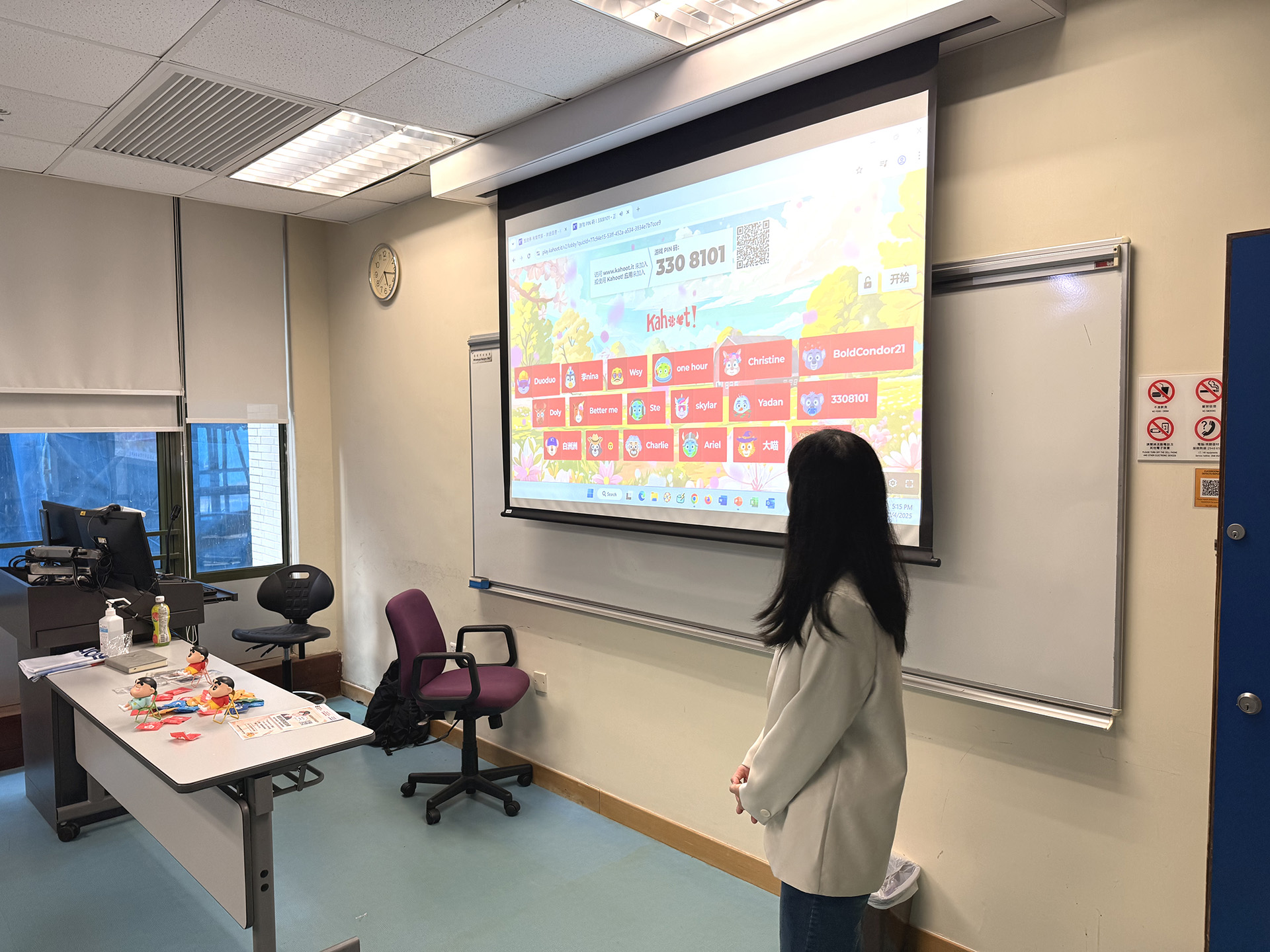

(Mar-Apr 2025) Personal Finance Programme’s Students Organize Campus Financial Literacy Workshop Series

The student team from EdUHK's Personal Finance Programme successfully organized a Campus Financial Literacy Workshop Series. Serving as keynote speakers, the students shared essential financial knowledge with their peers, contributing to the enhancement of financial literacy across the University.

The workshop series covered a diverse range of topics, including:

- Web 3.0 Investments

- Compound Interest Calculations

- MBTI-Based Financial Personality Analysis

- Economic Principles in Empresses in the Palace

These workshops provided participants with practical financial knowledge and actionable skills.

(Feb 2025) Personal Finance Programme Students Attended The 17th HKIB Outstanding Financial Management Planners (OFMP) Awards - Presentation Ceremony & Gala Dinner

Invited by The Hong Kong Institute of Bankers (HKIB), Personal Finance students attended The 17th HKIB Outstanding Financial Management Planners (OFMP) Awards - Presentation Ceremony & Gala Dinner. This event provided students with a unique opportunity to immerse themselves in the banking industry, particularly in the wealth management and financial planning sectors. It also offered invaluable exposure and networking opportunities which are essential for students’ future career development in the financial sector.

(Feb 2025) "Finance × Wealth Management × Personal Finance" Alumni Career Development Sharing Session

Personal Finance Programme at The Education University of Hong Kong (EdUHK) hosted the "Finance × Wealth Management × Personal Finance" Alumni Career Development Sharing Session in February 2025. Alumni representatives shared their career development experiences and professional growth insights across various fields.

The alumni speakers came from diverse sectors, including private equity investment, banking and financial services, academic research, and higher education. This event actively fostered "alumni-student" connections, expanded EdUHK's professional network in personal finance, and leveraged alumni career development resources.

(Jan 2025) Student Team from Personal Finance Programme Wins Bronze Award in Hong Kong's "Personal Finance Ambassador Programme 2024/25"

The student team "No to Scams" from the Personal Finance Programme won the Bronze Award in the Hong Kong "Personal Finance Ambassador Programme 2024/25." To date, the student teams have won awards for four consecutive years in the "Personal Finance Ambassador Programme", becoming proactive promoters of financial literacy on the EdUHK campus.

(Oct 2024 - Apr 2025) EdUHK Personal Finance Programme Collaborates with HKFWS to Safeguard Elderly Financial Well-being

The Personal Finance programme has strengthened its collaboration with the Hong Kong Family Welfare Society (HKFWS), mobilizing students to deliver financial literacy volunteer services in Hong Kong communities by participating in the 'Wealth Intelligence for Smart Elders Course' under the Elder Academy Scheme*. The student volunteers served as financial education assistants for HKFWS, providing tutoring to the elderly on how to use digital tools for personal finance. For instance, they guided seniors on how to utilize price-comparison mobile apps effectively.

*The scheme is implemented by HKFWS's Financial Education Centre.

(Sep 2024) Vice Chairman of Institute of Financial Planners Hong Kong Shares Insights on Wealth Management and Financial Planning Career Development in Greater Bay Area

Dr. Keith Yu, Vice President (Development) of the Institute of Financial Planners of Hong Kong, shared the latest developments in the wealth management industry in the Greater Bay Area and the career opportunities for Certified Financial Planners (CFP) with students enrolled in the personal finance programme at The Education University of Hong Kong.

(Sep 2024) Hong Kong Institute of Bankers Shares Insights on Green and Sustainable Finance in the Banking Sector

The Personal Finance programme invited Mr. Kenneth YU from the Hong Kong Institute of Bankers to share green and sustainable finance in the banking industry and exchange views with students on career development in the banking and green finance sectors in Hong Kong.

(Sep 2024) Hang Seng Bank Hong Kong Shares Insights on Wealth Management in Hong Kong's Banking Sector

Hang Seng Bank Limited was invited by the Personal Finance Programme of The Education University of Hong Kong (EdUHK) to share insights with students on wealth management in Hong Kong's banking industry.

During the sharing session, students from the Personal Finance Programme engaged in in-depth dialogue with the Hang Seng Bank team on topics such as Hong Kong's banking sector, wealth management, cross-border financial planning, and career development in the financial industry—particularly in banking.

(Sep 2024) Witness the Charms of a Financial Hub Through Financial Education Immersion: Personal Finance Programme Field Visit

The Personal Finance programme organized a series of engaging field trips, helping students gain deeper insights into Hong Kong's financial and commercial development. The students visited the IFEC Financial Education Hub, The Mills in Tsuen Wan, Hong Kong Monetary Authority (HKMA) Information Centre and some financial landscapes in Central.

香港電台第五台《奮發時刻JUPAS課程巡禮》介紹個人理財榮譽文學士課程(聯招編號JS8688)的課程特色

https://www.rthk.hk/radio/radio5/programme/study_hard/episode/989055