|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Academic Programmes and Student Numbers

The Institute continues to develop and offer new programmes

to students, and a new Professional course for Primary

School Teachers (Mathematics Teaching) was launched

in 2004/05. Due to demographic changes and the reduction

in the demand for school teachers as projected by the

Government, the total UGC-funded student number in FTE

terms was reduced by 8% from 2003/04 to about 5,000

as at June 2005. About 70% of this student population

was at the degree or above level, with about 400 students

in FTE terms taking postgraduate programmes.

Amongst the non-UGC funded programmes, the Bachelor

of Arts (Hons) in Tourism Management and the Bachelor

of Arts (Hons) in Event Management, developed in collaboration

with the University of Central Lancashire, were also

launched in the year. Of the self-funded programmes,

Project Yi Jin with about 700 FTE students, the professional

language upgrading course for English & Putonghua

Teachers with about 300 FTE students, and the Pre-Associate

Degree and Associate Degree programmes with about 300

FTE students were the most popular.

|

|

|

Income and Expenditure

In accordance with the revised Statement of Recommended

Accounting Practice, the Institute had consolidated

all its activities, including activities of its subsidiaries,

in the financial statements starting from the financial

year 2004/05. The accounting practice adopted by the

Institute has moved one big step closer to those adopted

in the private sector and in most universities internationally.

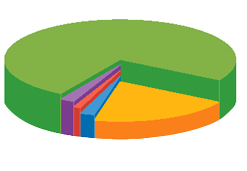

Income

The subventions from the UGC has reduced by $172 million,

from $939 million in 2003/04 to $767 million in 2004/05.

Other reductions in income came from the decrease of

almost $8 million in tuition, the reduction in donations

of around $19 million, and a drop of $7 million in other

income. Investment and interest income, on the other

hand, increased from $12 million to $25 million, as

the Institute continued to invest idle cash in different

financial products carrying a higher but reasonable

and acceptable level of risk, to enhance returns. The

average return improved from 1.5% in 2003/04 to 2.6%

in 2004/05, which was slightly better than the average

rate of a two-year fixed-rate-time deposit of 2.4%.

|

|

| |

|

|

Government

Subventions |

|

|

|

Tuition,

Programmes and Other Fees |

|

|

|

Interest

and Investment Income |

|

|

|

Donations

and Benefactions |

|

|

|

Auxiliary

Services |

|

|

|

Other

Income |

|

|

|

| |

|

|

|

|

|

Endowment,

donations, scholarships, bursaries and other sponsorships

received during the year amounted to $11 million, which

represented a large decrease from the prior year figure

of $30 million. Given the nature of courses offered

by, as well as the remote location and the short history

of the Institute, we are concerned that the Institute

may continue to find it difficult to attract major donations.

Nevertheless, the Institute will continue to spare no

efforts in making appeals to the community to contribute

towards funding of education. We eagerly seek out organisations/individuals

who share the vision of the Institute, and who are willing

to make donations, large or small, to support the work

of the Institute.

The second round of the Government matching grant scheme

to assist the UGC-funded institutions in fund raising

was launched in August 2005. Hopefully, it can help

boost up donation income in the next year.

The Institute's Division of Continuing Professional

Education ("CPE") continues to make steady

progress in the last three years. It has laid down a

firm foundation for income generation by raising its

income level from $44 million in 2002/03 to $62 million

in 2003/04, and then maintaining this income level of

$62 million in 2004/05.

Apart from the CPE, teaching departments had also been

active in bidding for new self-financing programmes/projects.

Total project income secured/awarded during the year

was slightly more than $80 million, bringing extra income

to the Institute in the coming one to three years.

With the reduction in UGC recurrent funding, the Institute

will have to rely increasingly on non-UGC funds. The

Institute is actively considering alternatives in this

regard. In spite of the various challenges, we are proud

that the Institute has staff members who have demonstrated

a willingness and capacity to go the extra mile as and

when needed.

Deflation experienced in Hong Kong for the last 6 years

appears to have come to an end. The average interest

rate in 2004/05 increased moderately by 1% to about

2.4% for a two-year fixed-rate-time-deposit in Hong

Kong dollars. The Institute had refined its risk-controlled

investment approach to include new instruments to cope

with the then roller-coaster investment markets. As

a result, a 200% increase in investment and interest

income was achieved in 2004/05 as compared with 2003/04.

|

|

|

|

|

|

|

|

|

|

|

|

|